A new poll from the University of Michigan finds that voters are more likely to support a carbon tax if it’s proceeds are invested in clean energy.

What Republicans like is of great interest to policymakers trying to find a way to pass climate legislation — because it is opposition in congress by Republicans that has been the obstacle.

For example, in one of the several attempts at passing climate bills back in 2010, Senator Cantwell of Idaho proposed one in which the proceeds from auctions (aka pollution fees) would be used to create a dividend returned to individual households.

The idea was that this would make it more attractive. But it turns out that even Republican voters prefer a ‘tax and invest’ strategy, where proceeds go to carbon free energy.

Problem with tax and dividend

Since the reason to have a carbon tax is to reduce carbon emissions — investing the proceeds in renewable energy is the only use of a carbon tax that makes any sense.

But the idea was that dividend would bring some voter buy-in to the idea, even a less effective carbon tax is better than none. Surprisingly, however, it turns out that voters don’t prefer this option, according to the new poll.

Key Findings

1. Most Americans oppose a carbon tax when the use of tax revenue is left unspecified. Overall support for such a tax is 34% in the latest NSEE survey. Attaching a specific cost to the carbon tax reduces overall support to 29%.

2. A revenue-neutral carbon tax, in which all tax revenue would be returned to the public as a rebate check, receives 56% support. The largest gains in support come from Republicans.

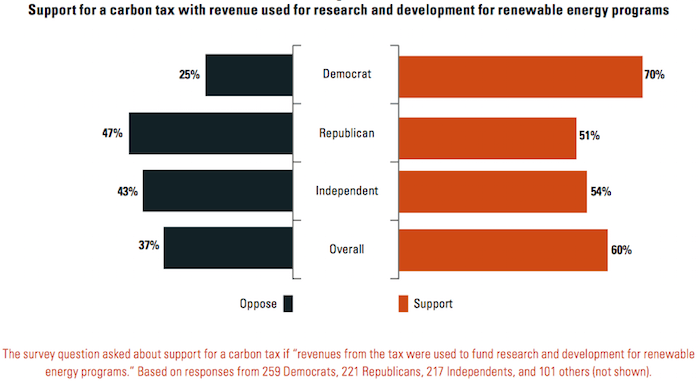

3. A carbon tax with revenues used to fund research and development for renewable energy programs receives 60% support, the highest among tax options that we presented. Majorities of Democrats, Republicans, and Independents each express support for this tax.

4. Most respondents oppose a carbon tax with revenues used to reduce the federal budget deficit. Overall support for such a tax is 38% with a majority of Democrats, Republicans, and Independents each expressing opposition to this tax.

5. When asked which use of revenue they prefer if a carbon tax were enacted, pluralities of Democrats, Republicans, and Independents each prefer renewable energy over tax rebate checks or deficit reduction.

The carbon taxes Republicans don’t like

Republicans polled vociferously oppose the other options — by 81% if there is no specific revenue use — and by 87% if it means 10% higher energy costs. They are less opposed a rebate check (53% against). But surprisingly, spending proceeds on renewable energy is the only option that Republican voters support more than oppose.

However, in the past, what congressional Republicans have said – if they’ll even consider the idea – is that it be used to lower corporate tax rates.

A corporate tax cut does nothing to speed the switch away from carbon energy. It doesn’t address the whole reason for a carbon tax. Just like a rebate to consumers, it is just moving money around within an economy, not away from fossil energy to renewable energy.

One successful model for spending the proceeds on renewables would be the currently operational Regional Greenhouse Gas Initiative involving nine Northeastern states, which uses auction revenues for carbon allowances under its cap-and-trade program to fund renewable energy and energy efficiency projects in those states.

It is very encouraging news that Republican voters prefer this obvious benefit of a carbon tax.

However, what prevents the US congress from passing carbon taxes is not the desires of Republican voters but the desires of those who fund the Republicans in congress.

Maybe the Koch brothers are the ones who should be polled!

Image credit: University of Michigan and FlickR