One of the most common questions people ask when they are considering installing solar panels on their home is “How much do solar panels cost?”.

To answer that question, let’s take a look at the average solar panel installation cost and what affects that cost. We’ll also look at a few simple ways to lower those costs and the best way to get a truly accurate estimate of solar panel cost for your home.

3 Methods to Estimate Solar Panel Cost

There are several different ways to estimate solar installation cost.

- Guess using the US average solar panel costs. (the current average is around $18,600 but it can vary greatly by your home and location)

- Get a better estimate for your specific home with our free solar panel cost calculator below.

- Get a true estimate with free quotes from professional solar installers

As I mentioned above, typically homeowners typically spend around $3 per watt for a complete solar panel system with installation. Considering the average home installs a 6,200-watt solar panel system, the average homeowner has an estimated cost of $18,600 to install solar panels. This is just the national average though and so your actual costs may be much more or much less depending on many factors such as location and your specific home. A better way to get an estimate of how much solar panels may cost you to install on your home is with our free online solar panel cost calculator below.

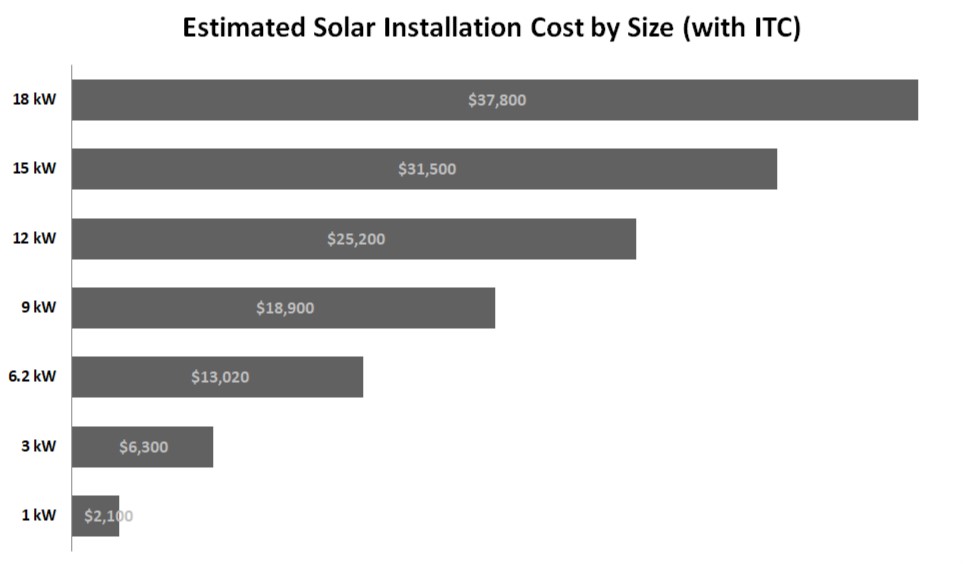

Solar Installation Costs By System Size

The single biggest factor when calculating solar panel cost is the size of the installation.

Odds are that your actual install will cost more (or less) than that $18,600, as you probably don’t need that exact 6.2 kW installation. A bigger house or a bigger family typically means a bigger solar installation, and that means a bigger cost. Take a look at the graph below, where we lay out estimated solar costs by installation size, to see what we mean.

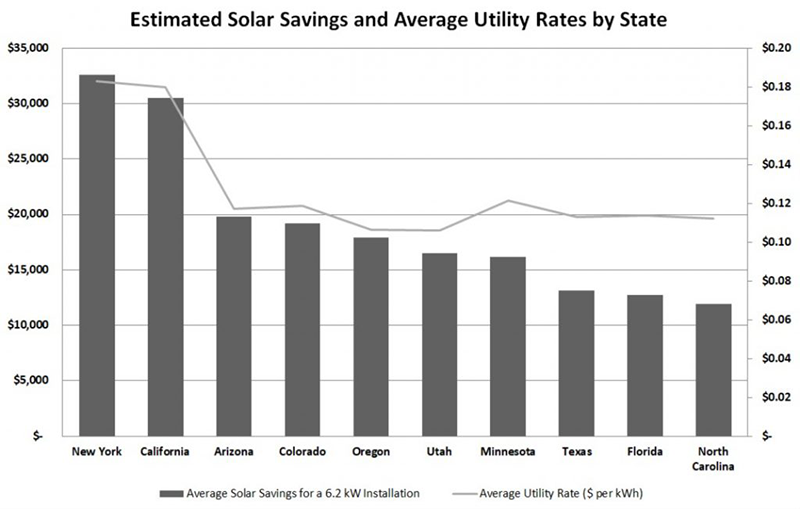

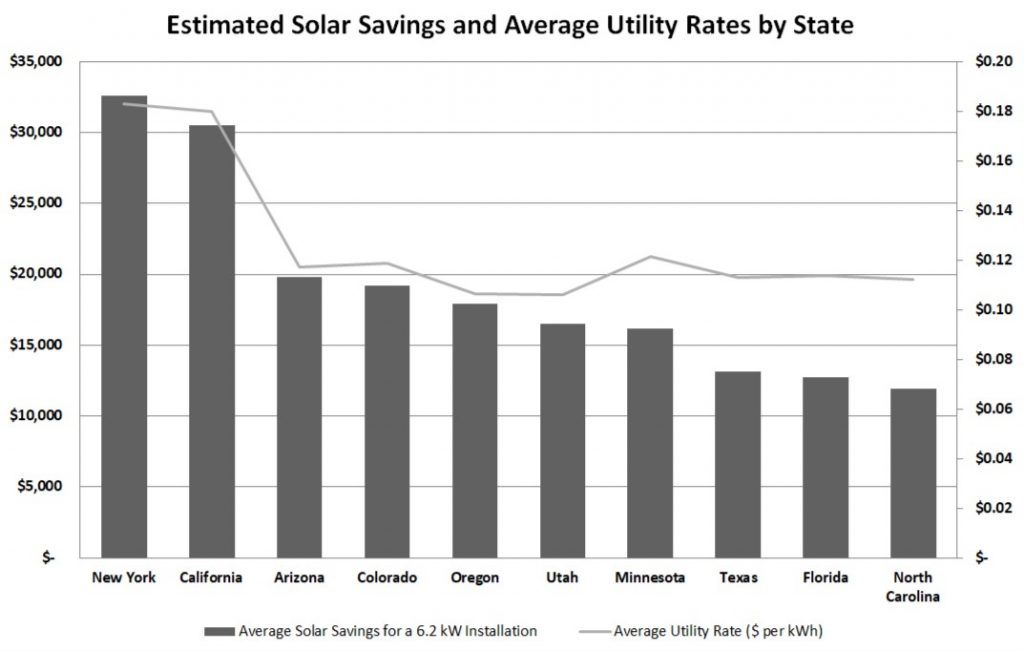

Solar Costs By State

While size is the most important factor, costs also vary state to state. We mentioned that the average cost is about $3 per watt, but in reality prices range from a low of $2.70 in some states to $3.70 or more in others. We previously looked into average $/watt installation costs state to state, and here are a few highlights from across the country:

You can see that, just in this small sample, costs vary by as much as $0.71. And remember that’s a $0.71 difference per watt. For a 6,200 watt installation, that’s a total cost difference of $4,400. While California and Arizona are in the middle, those states are generally good value because they have higher production given the amount of sunlight exposure.

How The Federal Investment Tax Credit (ITC) Comes Into Play

The good news is that, no matter where you live, there are tax credits and financial incentives for solar homeowners. None of the figures above include any of the credits or rebates that you may qualify for and they can go a long way to helping you reduce the cost of solar.

The federal Investment Tax Credit (also known as the ITC or federal solar tax credit) is the single biggest financial incentive for solar homeowners, and all homeowners are eligible for this awesome credit! It allows you to claim a federal income tax credit equal to 30% of your solar panel installation costs. With the $18,600 installation above, you’d be eligible for a $5,580 tax credit, which drops your total solar investment down to $11,220. Needless to say, that’s huge savings!

There are a couple key points to know about the federal ITC:

- At the end of 2019, the tax credit will drop from 30% to 26%, so if you’re thinking about going solar, do it this year. When the new decade starts, your investment cost will go up! In 2021, that credit will drop to 22%, before completing dying off at the end of 2021.

- The federal ITC is a non-refundable tax credit. Let’s say your solar tax credit is equal to $5,000, but you only owe $4,000 at tax time. The IRS will not write you a check for that $1,000 difference, as the ITC is non-refundable. It will only drop your owed taxes to $0. If you’re on a fixed income or retired, talk to your tax preparer to see if you can fully benefit from the credit. It’s not all bad news though. If you don’t owe enough in a single year, the IRS allows you to break the tax credit down and claim portions over several years.

- The tax credit goes to the owner of the solar installation. If you buy your own solar installation via cash or a loan, you are eligible for the tax credit. If you finance via a lease (like is common at Sunrun and SolarCity/Tesla), the company – not you – owns the installation and the tax credit.

A good solar installer can help you out with these incentives and rebates and provide you with information about the programs that you may qualify for. Some, like the federal ITC, you’ll apply for yourself after the installation is complete. Other incentives, like utility rebates, your installer will likely help you out with or even apply for on your behalf. They should know exactly how to maximize your incentives to the fullest potential by using any local and federal programs available.

Remember that since not every home will have the same energy consumption rates, even if they are the same size, it is recommended to utilize a professional solar installer in order to get an accurate estimate for your home and household needs.

What Affects Solar Panel Installation Costs

When you pay for your installation, you’re not just paying for the solar panels. You’re also paying for the other equipment like the inverter, wiring, and mounting hardware as well as the install labor, design, permitting fees, sales tax, marketing, and sales process. Fun fact: the solar panels only account for about 15% of your total installation cost!

On top of that, you may also need shingle repairs, roof upgrades, or tree trimming or removal if your roof gets too much shade. These can add a couple hundred bucks to thousands of dollars to your final investment cost.

Of course, installers aren’t just trying to be annoying or up-sell with these repairs. Experts estimate that solar installations should last 25 years or more – quite a long time. The best solar installers will point out whether your shingles should be replaced beforehand, as removing solar installations to replace a roof typically costs $2,000 or more. If your shingles are just old and worn out, they’ll likely recommend a complete re-roof. If there’s just localized damage where you want to install solar – maybe water or hail damage for example – you can typically just replace the shingles that will be covered by the solar panels.

It can be extremely frustrating if your installer recommends new shingles before you install your solar panels. However, they’re just looking out for your best interest. It’s much better to know all of this now before you have a solar installation on your roof, then to find out in 10 years!

Almost all solar installers either perform roof repair themselves or have a company they work with that’ll cut a discount to do both together, but we encourage you to bid out the process before making any decisions. More options don’t hurt!

A solar installation expert will be able to give you a quote that should include all of your total costs to install solar panels on your home properly, and in the most efficient manner possible.

Are Solar Panels a Good Investment?

With all these expenses, you’re probably wondering whether installing solar is even still a good investment. That’s a great question!

In a word, absolutely. In fact, with installation costs dropping over 60% since 2010, solar is a better investment than ever before! And while the price of solar technology continues to drop, the price of utility electricity continues to go up. In the last 15 years, utility rates have increased an average of 2.9% each year.

That’s actually the main crux of solar savings. You pay a one-time fee (ie your installation cost) in 2019 to install solar and you’re then able to avoid those utility price hikes – as well as the current high utility prices – for the next 25 years.

Obviously, some states like California, New York, and Hawaii have much higher utility rates than in other states, so solar savings will be greatest in those states, but that doesn’t mean it’s a bad decision in other areas. Let’s take a look at those same states we looked at earlier:

You can see that generally speaking, savings follows utility costs, but you’ll also notice that lifetime solar savings is between $12k and $32k across the board.

You can also see that homeowners in certain states like Utah, Oregon, and Colorado, see higher savings thanks to incentives or stronger sunlight than states like Florida and Texas which enjoy similar utility rates but offer zero or few solar incentives. But even in those states, installing solar on your roof is still a worthwhile investment!

3 Ways to Reduce Solar Panel and Installation Costs

Here are some ways that you can save on your solar panel costs and find the best deals, while still ensuring that you get a high-quality solar system and installation.

1. Shop Around and Compare Solar Panel and Installation Prices

One of the most important tips we can offer is to shop around and speak to multiple companies to get their rates, costs, and estimated savings to find the best deal and best company for your needs. In fact, a 2017 study by the National Renewable Energy Lab concluded that smaller local solar panel installers frequently charge about 10% less than large national solar panel installers such as SolarCity and Sunrun, likely thanks to lower marketing and customer acquisition costs, so be sure to explore local options.

That said, you should explore all of your options as there can be perks and money-saving discounts from both national and local companies depending on your needs and location.

2. Pay For Everything In Cash

If you can afford to pay upfront in cash then you probably should. It is the easiest way to save thousands of dollars on interest, leasing fees, and all the other expenses that financing will require.

Just to show you how much you can save by paying in cash, let’s imagine you took out a 5% interest, 12-year loan to pay for your $18,600 solar installation. After Year 12, you’ll have paid off your entire installation, but you’ll also have paid an extra $6,172 in interest!

If you have the money to do it, then bite the bullet and pay up front! You will save as much money as possible in the long run and be glad that you did when you total up your exact solar panel cost after installation.

3. Take Advantage of ALL Available Solar Tax Credits, Incentive Programs, and Rebates

As mentioned above, solar tax credits and rebates are certainly one of the very best ways to save money on solar costs. Talk to a professional installer and find out what local and federal programs are available for your home. Taking advantage of all of the available incentives can equate to tremendous savings in many cases. Remember though that many incentive programs are limited and many (if not most) are already expired, so talk to an installer and act quickly so that you do not miss out on these possible savings.

As of 2019, there are still some great incentives around! South Carolina, for instance, offers a 25% state tax credit for solar installations. Together with the similar federal tax credit, this adds up to a 55% discount on the entire cost of your solar installation! The state of Utah offers a similar tax credit worth 25% of the installation cost, or $2,000, whichever is less.

Be sure to research a bit to see if your own state or utility offers any rebates or tax incentives!

How To Calculate How Much Solar Panels with Installation Will Cost for YOUR Home

The best way to calculate the true cost of your solar panel panels with installation, and how much you could save on electricity, is to get a free estimate from a solar professional.

We highly recommend this approach as it will save you time and give you the most accurate estimate available for your expected solar panel costs.