California is doing even better in its pursuit of clean energy than we thought, and the pace at which it is adding solar and wind, especially, is accelerating.

The state’s Public Utilities Commission (CPUC) said its latest Renewables Portfolio Standard (RPS) Quarterly Report [PDF] shows that a record 839 megawatts (MW) of new renewable capacity came online in 2011, and that in 2010, the state’s big three investor-owned utilities together hit the 17 percent mark in renewables. Just a month ago, a report from the California Energy Commission had the state at 16 percent renewables in 2010, but the utilities that provide about two-thirds of the state’s electric retail sales are doing even better than that.

The star performer is Southern California Edison, which in 2010 served 19.3 percent of its electricity with renewable energy. Pacific Gas and Electric was next at 15.9 percent, while San Diego Gas & Electric trailed at 11.9 percent. The state’s RPS requires the three big utilities to increase the amount of renewable generation sold to customers to an average of 20 percent per year from January 1, 2011, to December 31, 2013; 25 percent by December 31, 2016; and 33 percent by December 31, 2020.

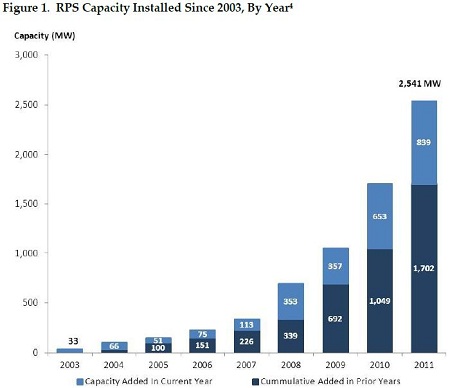

The CPUC said the utilities were expected to reach the current goal, and the trend lines certainly point in that direction. Since 2005, each year has brought more new renewables than the previous year (see above chart). The 839 MW of capacity the utilities added in 2011 was made up entirely of wind and solar, and brought the state to 2,541 MW of renewable energy capacity.

For the first time this latest CPUC quarterly report included data on the cost of the renewable energy—and the costs have gone up. The report said the weighted average time-of-delivery costs of all contracts went from 5.4 cents in 2003 to 13.3 cents per kilowatt-hour in 2011. How does that fit with reports that costs of solar and wind are falling? According to the CPUC, the issue is that “in the beginning of the program, the utilities contracted with existing renewable facilities, allowing for lower costs.” After the existing sources were tapped out, new plants, “which require higher contract costs to recover the capital needed to develop a new facility,” drove up the cost.

But there’s good news around the corner, the CPUC said: “Most recently, bids from the 2011 RPS Solicitation, not yet available for inclusion in the report, show significantly lower costs, which will be reflected in future investor-owned utility contracts.”

The CPUC noted in its report that while the RPS is the “primary vehicle for new utility-scale renewable energy development in California, there are other programs that stimulate development of customer-sited renewable generation.” It cited the California Solar Initiative (CSI) and Self-Generation Incentive Program (SGIP), which it said “provide incentives for customers to install renewable distributed generation technologies that directly serve their on-site load.”