If technology were keeping residential solar power from reaching its full potential, that would be one thing. But red tape? Preposterous as it sounds, that’s a substantial reality in the United States, according to a new report.

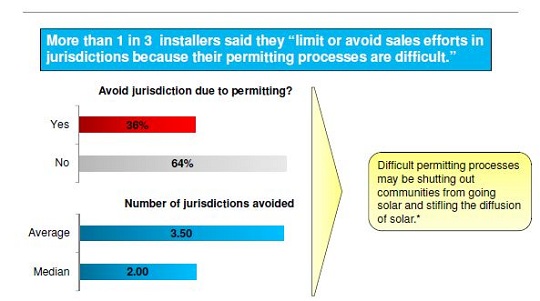

Clean Power Finance, in a study supported by the U.S. Department of Energy’s SunShot Initiative, said on Wednesday it found that more than a third of solar installers avoid selling solar in “otherwise viable markets” because of permitting issues. Not only could that limit adoption of solar in those markets, but by tamping down competition it could lead to higher prices.

“The study puts real numbers to what all installers have been feeling: permitting is an albatross around the industry’s neck,” Patrick Redgate, CEO of Southern California-based installer Ameco Solar, said in a press release that accompanied the report. “Clearly, not all cities are bad, but we need to call out the ones that are particularly problematic.”

The study focused on “authorities having jurisdiction” (AHJs), including municipalities and utilities, who oversee residential solar permitting processes. It found that from place to place, processes can vary (itself a complicating factor for installers), but almost always installers have to deal with more than one agency within an AHJ – and sometimes it could be as many as five.

“The more entities involved in the permitting process, the more likely there are to be mixed messages and/or different rules that result in delays and increased costs for installers and more paperwork for AHJs,” Clean Power Finance said.

Installers spend nearly two full days of work time in cutting through the red tape, but that’s just one aspect of the process, the report said:

AHJs require, on average, nearly 8 work weeks to complete their tasks. Staff times for installers, however, average just 14.25 hours. Because installers typically make a large upfront equipment purchase, permitting processes can tie up thousands of dollars for almost two months or force installers to use credit, both of which can impede installer profitability or force them to pass on additional costs to consumers.

But the Clean Power Finance report wasn’t putting all the blame here on the AHJs which, after all, have a duty to ensure that potentially dangerous power systems are installed safely. The study noted challenges that AHJs face, including:

- installer errors and incomplete or inconsistent paperwork that create extra work and delays for staff;

- sub-optimal conditions that include strained budgets, lack of resources and high staff turnover;

- in some areas where solar installations are less common, a lack of awareness of existing practices or that problems exist for installers;

- and, even where AHJs understand solar and want to work with installers, no channel by which they can communicate to installers about updates or process improvements.

It all contributes to very high “soft costs”– basically, everything except the equipment in a solar power system – often cited as a chief factor in keeping U.S. installed solar prices, at around $6 per watt by latest estimates, well above those is in, say, Germany ($3.20/W ) or Australia ($4/W). The DOE has called reducing these costs “the greatest challenge to achieving cost-competitive solar by 2020.”

The National Solar Permitting Database that Clean Power Finance developed with SunShot support is offered up as a tool to improve the situation. The more companies and AHJs that participate, Clean Power Finance has said, the more understanding everyone will have – on both sides of the process – on how to make things work more smoothly.

The Clear Power Finance study, “Nationwide Analysis of Solar Permitting and the Implications for Soft Costs” [PDF], was conducted in the summer of 2012 and surveyed 273 residential installers, gathering data on 546 installations spanning 12 states that make up more than 90 percent of the U.S. residential solar market.