Pricing carbon makes such obvious sense that from Robert Reich on the left to Gregory Mankiw on the right, economists overwhelmingly agree that a carbon tax that helps reflect the true costs of fossil-fuel use would be the most efficient way to spur clean-energy development.

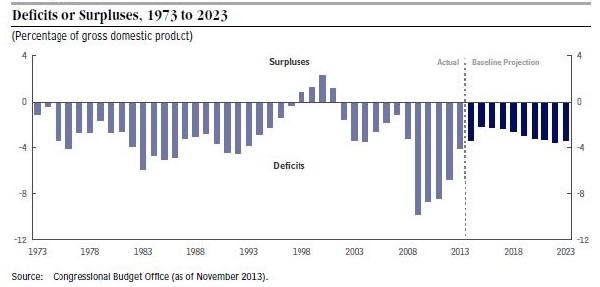

Turns out it could also cut the deficit by a whole heckuva lot. In fact, a new report from the Congressional Budget Office [PDF] finds it would do more to reduce the U.S. budget deficit – saving $1.060 trillion in the 2014-2023 period with carbon taxed at $25 per metric ton – than any other single measure considered.

The CBO acknowledges that imposing the tax, would which rise at an inflation-adjusted rate of 2 percent per year, would “increase businesses’ costs, which would reduce the tax bases for income and payroll taxes,” and its calculations reflect those lost revenues. So that $1.060 trillion in deficit reduction is the bottom-line fiscal impact (of course, there would also be benefits in improved health, etc.).

Now, a “discussion draft” of carbon tax legislation was unveiled earlier this year, but it doesn’t seem to have prompted a whole lot of talk. Maybe the CBO report will change that. The two pages devoted to a “tax on emissions of greenhouse gases,” as the CBO termed it, is definitely worth reading. It lays out the arguments for and against such a tax in a direct way, providing an excellent primer on a discussion the country really needs to have.

After the jump – Option 35: Impose a Tax on Emissions of Greenhouse Gases

From the CBO Report, Options for Reducing the Deficit: 2014 to 2023, Option 35: Impose a Tax on Emissions of Greenhouse Gases:

The accumulation of greenhouse gases (GHG) in the atmosphere – particularly carbon dioxide (CO2) released as a result of burning fossil fuels (such as coal, oil, and natural gas) and because of deforestation – could generate damaging and costly changes in the climate around the world. Although the consequences of those changes are highly uncertain and would probably vary widely across the United States and the rest of the world, many scientists think there is at least a risk that large changes in global temperatures will trigger catastrophic damage. Among the less uncertain effects of climate change on humans, some would be positive, such as reduced deaths from cold weather and improvements in agricultural productivity in certain areas; however, others would be negative, such as declines in the availability of fresh water in areas dependent on snow melt and the loss of property from storm surges as sea levels rise. Reducing global emissions of greenhouse gases would decrease the extent of climate change and the expected costs and risks associated with it. The federal government has begun to regulate some of those emissions, but it does not directly tax them.

This option would place a tax of $25 per metric ton on most emissions of greenhouse gases in the United States – specifically, on most energy-related emissions of CO2 (for example, from electricity generation, manufacturing, and transportation) and some other GHG emissions from large manufacturing facilities. Emissions would be measured in CO2 equivalents (CO2e), which reflect the amount of carbon dioxide that would cause an equivalent amount of warming. The tax would increase at an annual real (inflation-adjusted) rate of 2 percent. During the first decade the tax was in effect, the Congressional Budget Office estimates, emissions from sources subject to the tax would fall by roughly 10 percent. According to estimates by the staff of the Joint Committee on Taxation and CBO, federal revenues would increase by $1.06 trillion over the same period. (The tax would increase businesses’ costs, which would reduce the tax bases for income and payroll taxes. The estimates shown here reflect the resulting reductions in revenues from those sources.)

The size of the tax used for these estimates was chosen for illustrative purposes, and policymakers who wanted to pursue this approach might prefer a smaller tax or a larger one. The appropriate size of a tax on greenhouse gas emissions, if one was adopted, would depend on the value of limiting the magnitude of climate change and its associated costs, the way in which the additional revenues were used, the effect on emissions overseas, and the additional benefits and costs that resulted from the tax.

One argument in support of the option is that it would reduce emissions of greenhouse gases at the lowest possible cost per ton of emissions because each ton would be subject to the same tax. That uniform treatment would increase the cost of producing and consuming goods and services in proportion to the amount of greenhouse gases emitted as a result of that production and consumption. Those higher production costs, and corresponding increases in prices for final goods and services, would create incentives throughout the U.S. economy to undertake reductions of greenhouse gases that cost up to $25 per metric ton of CO2e to achieve. An alternative approach to reducing GHG emissions that is currently being pursued by the federal government is to issue regulations based on various provisions of the Clean Air Act (CAA). However, standards issued under the CAA (for example, specifying an emissions rate for a given plant or an energy-efficiency standard for a given product) would offer less flexibility than a tax and, therefore, would achieve any given amount of emission reductions at a higher cost to the economy than a tax.Another argument in favor of a GHG tax is that such a program could generate “co-benefits.” Co-benefits would occur when measures taken to reduce GHG emissions – such as generating electricity from natural gas rather than from coal—also reduced other pollutants not explicitly limited by the cap, thereby reducing the harmful effects associated with those emissions. One study estimated that reductions in other pollutants that would occur as a byproduct of a $29 tax per ton of CO2 emissions could be worth between $10 and $20 per ton in terms of the benefits to human health.1 However, measures taken to decrease CO2 emissions could also create additional costs depending on how the emissions were reduced. For example, increased nuclear generation could exacerbate the problem of lack of adequate long-term storage capacity for nuclear waste.

An argument against a tax on GHG emissions is that curtailing U.S. emissions would burden the economy by raising the cost of producing emissions-intensive goods and services while yielding benefits for U.S. residents of an uncertain magnitude. For example, most of the benefits of limiting climate change might occur outside of the United States, particularly in developing countries that are at greater risk from changes in weather patterns and an increase in sea levels. Another argument against this option is that reductions in domestic emissions could be partially offset by increases in emissions overseas if carbon-intensive industries relocated to countries that did not impose restrictions on emissions or if U.S. reductions in energy consumption led to decreases in fuel prices outside of the United States. More generally, averting the risk of future damage caused by climate change would depend on collective global efforts to cut emissions. Most analysts agree that if other countries with high levels of emissions do not cut those pollutants substantially, reductions in emissions in this country would produce only small changes in the climate (although such reductions would still diminish the probability of catastrophic damage).

An alternative approach for reducing emissions of greenhouse gases would be to establish a cap-and-trade program that set caps on such emissions in the United States. Under such a program, allowances that conveyed the right to emit 1 metric ton of CO2e apiece would be sold at open auction, and the cap would probably be lowered over time. If the caps were set to achieve the same cut in emissions that was anticipated from the tax, then the program would be expected to raise roughly the same amount of revenue between 2014 and 2023 as the tax analyzed here. Both a tax on GHG emissions and a cap and-trade program for those emissions would represent market-based approaches to cutting emissions and would achieve any desired amount of emissions reduction at a lower cost than the regulatory approach described above. In contrast with a tax, a cap-and-trade program would provide certainty about the quantity of emissions from sources that are subject to the cap (because it would directly limit those emissions), but it would not provide certainty about the costs that firms and households would face for the greenhouse gases that they continued to emit.