Forget about the rise of f-ing (fracking, of course) natural gas. Renewables are rising faster, the world’s leading energy watcher reports, and by 2016 global power generation from the clean stuff will beat gas.

Now, it’s important to note that unlike many states in the U.S., the International Energy Agency counts hydropower as a renewable, and on that basis figures that generation from renewables is “expected to surpass that from natural gas and double that from nuclear power by 2016, becoming the second most important global electricity source, after coal.”

But even taking hydro out of the picture, the IEA, in its second annual Medium-Term Renewable Energy Market Report (MTRMR), sees renewables pushing ahead strongly.

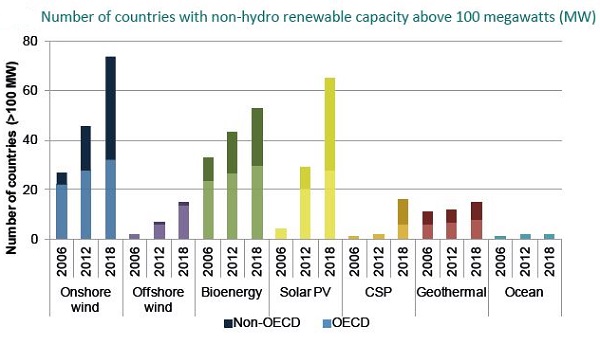

Driven by fast-growing generation from wind and solar photovoltaics (PV), the share of non-hydro renewable power is seen doubling, to 8% of gross generation in 2018, up from 4% in 2011 and 2% in 2006. In the Organisation for Economic Co-operation and Development (OECD), non-hydro renewable power rises to 11% of OECD gross generation in 2018, up from 7% in 2012 and 3% in 2006.

The report, as described in an available-for-free executive summary [PDF], talks about challenges that have emerged since last year’s MTRMR. The spotty economic recovery from 2008-09 has been a problem, as “investment moderated in the face of macroeconomic uncertainties and incentive reductions, particularly in countries with strong deployment of solar PV.” That would be in many European countries.

Nevertheless, deployment of renewables actually surpassed expectations last year.

Part of the strength in 2012 growth stemmed from stronger-than-anticipated hydropower production, particularly in China. Yet it also reflected a continued rapid build-out of non-hydro sources, whose generation rose by 16% year-on-year. Among the OECD regions, non-hydro renewable generation was the second-largest source of power generation growth in 2012, expanding by 90 TWh. By comparison, gas-fired generation rose by over 150 TWh, while both coal and nuclear declined. Globally, the most dynamic sectors – solar PV and onshore wind – grew faster than expected in the MTRMR 2012, spurred by falling generation costs. Still, the expansion of other technologies – offshore wind, CSP, geothermal – remained more moderate, owing to relatively higher costs and more challenging financing situations.

Wind in particular is becoming more competitive with fossil-fuel sources, meaning that even without the obvious necessity of responding to climate change, it can be the smart choice for new generation.

In some markets with good resources, the levelised cost of electricity (LCOE) for onshore wind is competitive or close to competitiveness versus new coal- and natural gas-fired power plants. In Brazil, onshore wind competes well with new gas-fired plants and other historically less expensive renewable sources, such as hydropower and bioenergy. In Australia, wind is competitive versus the generation costs of new coal- and gas-fired plants with carbon pricing, and the best wind sites can compete without carbon pricing. In Turkey and New Zealand, onshore wind has been competing well in the wholesale electricity market for several years. With long-term power purchase agreements (PPAs), onshore wind costs are approaching that of new coal-fired plants in South Africa. In Chile and Mexico, onshore wind competes – or is close to competing – with new gas-fired plants. In the United States, although onshore wind remains more expensive than new gas-fired generation, long-term PPAs for wind power can provide cost-effective hedges against rising fuel prices over the long term, even without federal tax incentives.