The solar power sector is a topsy-turvy one, with companies, subsidies and technologies rising and falling. But there’s no question about what region has been driving a market that, overall, continues to grow: It’s Europe.

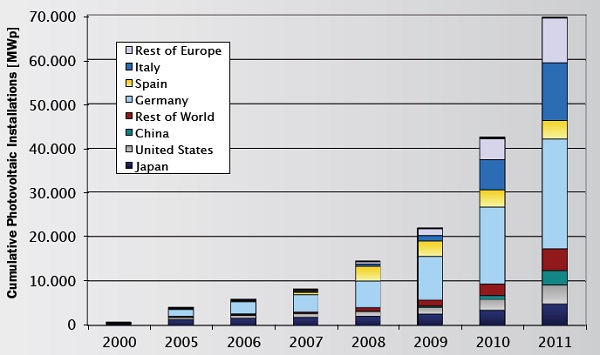

As of the end of 2011, the Europe Union accounted for 70 percent of the cumulative solar photovoltaic capacity installed worldwide – 51 out of 70 gigawatts – according to a new EU report [PDF].

Germany gets much of the credit for European PV dominance; a separate report released this week said 320 megawatts installed in August pushed the German total over 30 GW.

Smaller countries are nowhere in the same league, but some are showing steep growth. A division of the Danish Ministry of Affairs said this month that thanks to net metering instituted in 2010, Denmark will reach its 2020 goal of 200 MW capacity this year. The government said that according to major energy companies in the country, the country will have 1 GW of solar installed by 2020 and 3.4 GW by 2030.

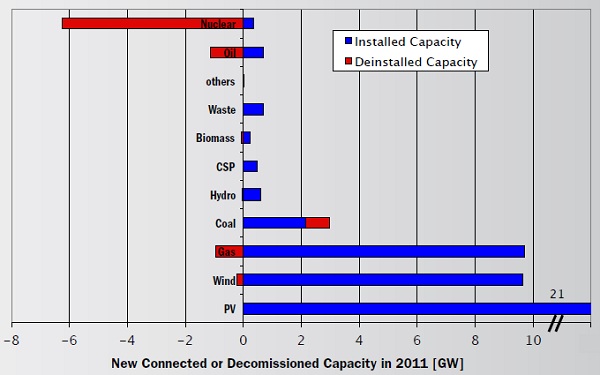

Impressive as these totals are, the European Union report highlights how far solar power has to go to become a major contributor to electricity production. A statement [PDF] that accompanied the report notes that solar production amounts to about 2 percent of the EU’s electricity needs – equivalent to Austria’s demand. But it is making up ground, as this chart shows:

In addition, the report notes that in that in Germany and Italy, “the installed PV capacity will exceed 30 percent and 20 percent of the installed thermal power plant capacities respectively. Already on 25 May 2012, more than 22 GW of solar power were on the German grid, covering more than 30 percent of the total electricity demand at noon. Together with the respective wind capacities, wind and solar together will exceed 60 percent and 30 percent respectively.”

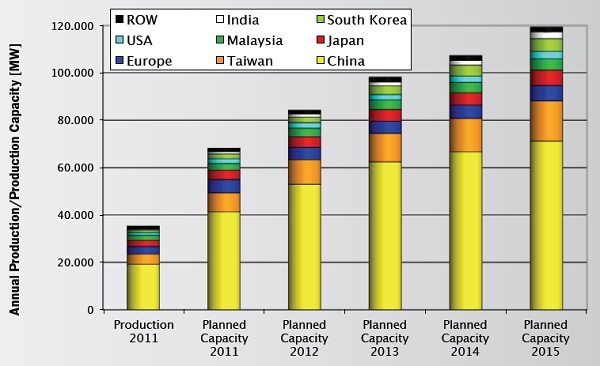

The report also puts a spotlight on the confusing state of the solar manufacturing sector, both in Europe and abroad.

“Despite the fact that about three dozen companies declared bankruptcy, stopped production or announced a scale-back or cancellation of their expansion plans for the time being, the number of new entrants into the field, including some large semiconductor or energy-related companies overcompensated this,” the EU analysis says. “At least on paper the expected production capacities are still increasing.”

What’s driving this optimism among manufacturers?

“Even with the current economic difficulties, the number of market implementation programmes world-wide is still increasing,” the report says. This, as well as the overall rising energy prices and the pressure to stabilise the climate, will continue to keep the demand for solar systems high. In the long-term, growth rates for photovoltaics will continue to be high, even if economic frame conditions vary and can lead to a short-term slow-down.”

The result for buyers has been nothing but good news, as prices have plunged, although the report notes that the average system price for small systems (under 100 kilowatts) ranged from $2.3 per watt in Germany to at least $6 in California and Japan.

“According to Bloomberg New Energy Finance (BNEF), one reason for the higher prices in California and Japan is the fact that installers are not passing on the full benefit of PV system price decline to their customers,” the report says. “BNEF expects a further price reduction there in line with the decrease of incentives.”

One thing the report doesn’t get into is the issue of trade skirmishes over solar. China has become the big dog when it comes to manufacturing, now accounting for more than half of the world’s PV production – a number that could rise to more than 61 percent by 2015, the report says. That’s led to preliminary trade sanctions in the United States, and initiation of a probe by EU authorities.