Third-party installs – where homeowners get rooftop solar power but don’t buy the panels – have accounted for 68 percent of all new systems installed in California so far in 2012, according to the latest PV Solar Report sponsored by Sunrun. And the trend is apparently accelerating.

“About 75 percent of Californians switching to solar now choose solar power service,” Sunrun’s Lynn Jurich said in a statement that accompanied the report.

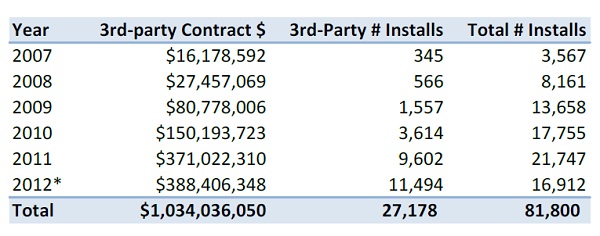

This trend isn’t newly discovered, but the scope of the market transformation indicated in the new data is nonetheless striking. Last year, 44 percent of installs used the solar lease or power purchase agreement (PPA) model; in 2010 it was 20 percent; and in 2009, 11 percent.

The analysis, which uses utility rebate data through August 15, also notes that the value of the third-party contracts since the solar power service model first popped up in 2007 has busted through the $1 billion mark.

In the past, the report has suggested that solar leases and power purchase agreements were helping solar make inroads into middle-income neighborhoods. The new report bolsters that assertion: installs in areas with median incomes between $50,000 and $75,000 are up nearly five times since 2007, compared to merely doubling in the above-$100,000 income group.

While solar service can be the best – and only – model for some homeowners, analysts say those who have options should compare that scenario with the likley costs and benefits of purchasing a system. John Farrell of the Institute for Local Self-Reliance recently suggested analyzing the choice using these guidelines:

- Projected Savings: How do projected savings compare to ownership?

- Inflation Assumptions: A lease typically has two inflation rates, one for the lease payment (fixed) and one for the grid electricity price (a guess). If the latter ends up being lower than forecast (I’ve seen them as high as 5%!), it can significantly reduce projected savings.

- Lease End: What happens when the lease expires? Can the system be purchased? How does the purchase price compare to the projected savings to that point? This is very important because of the potential value of the solar array to the resale price of the home. Also one can inquire whether an inverter replacement already been done when the system is available for purchase.

- Company History: Will the company be around in 10-15 years to fulfill their lease requirements?