By Thalia Assuras/Silvio Marcacci, energyNow!

The U.S. clean energy industry is facing an uncertain future because of the slow economy, low-cost overseas competition, and political gridlock in Washington, D.C. But in spite of these headwinds, Energy Secretary Steven Chu says clean energy cannot be abandoned and is on track for cost parity with fossil fuels.

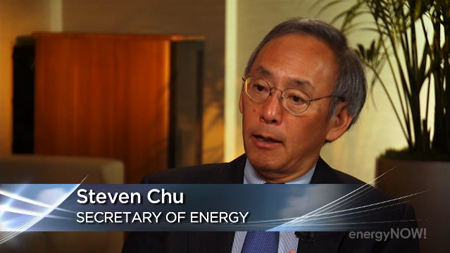

In an interview, energyNOW! anchor Thalia Assuras discusses the outlook for clean energy funding, the Obama’s Administration’s plans to advance energy technology, and global competition with Secretary Chu.

International competition has made the market for renewable energy technology “very competitive” but the U.S. shouldn’t abandon its efforts. “The market for solar energy, for renewable energies of all kind, and for the energy market in general is so vast that we have to hang in there and prevail,” said Chu.

R&D is key because technological advances drive costs down, evidenced by solar power’s march to cost parity. “Its price has come down 50 percent in the last five or six years, it’s going to come down by another 50 percent, and we think there’s a chance it could come down by 70 percent,” he said. “At that point, you’re talking about wholesale electricity at utility scale, at 6 or 7 cents levelized cost per kilowatt hour – that’s as much as you would have to spend for any fossil fuel plant without subsidy.”

Chu also thinks renewables will soon be able to stand on their own. “Oil and gas subsidies have been continued for about a hundred years,” he said. “I think we can pull the plug on renewable energy way before that, another 10 or 15 years.”

Chinese investment holds lessons for the U.S. to learn. China is “generating within their own country the largest renewable market in the world,” he said. “That creates manufacturing in their country, and that manufacturing can be used for export.”

America needs to take note of China’s march, concluded Chu. “10 and 20 years from now, the world’s going to need this (clean energy and infrastructure). Are we going to be buying or selling? We’d rather very much be selling.”

You can watch the full video below:

![]() Editor’s Note: This video content comes to us as a cross post courtesy of energyNow!. Author credit for the segment goes to Thalia Assuras and Silvio Marcacci.

Editor’s Note: This video content comes to us as a cross post courtesy of energyNow!. Author credit for the segment goes to Thalia Assuras and Silvio Marcacci.